Where will Affirm Holdings Inc. (AFRM) exist in the upcoming few years? You will find the precise 2025 to 2030 forecast in this article. This piece of research examines company statistics and adds expert analysis and technical examination to provide a forecast prediction.

Our article presents information in an approachable manner through brief sections along with informal communication. This article serves both investors and students by exploring monthly projections about buy-now-pay-later technology and its associated risks and technical analysis as well as further information.

Company Introduction and Statistical Analysis

The well-established financial technology company Affirm Holdings Inc operates its payment network across the United States, Canada and different international territories. The company Affirm came to life in 2012 at its main location in San Francisco California where it provides time-based point-of-sale financing options to customers acquiring goods.

Affirm’s client base features different sizes of merchants that span from small businesses to big enterprises and omni-channel brands and its business areas extend to fashion and travel and electronics and general merchandise. Users can obtain more information by visiting the official Affirm website.

Key Financial Statistics

Here are some vital figures that provide a snapshot of Affirm’s current market position (as of March 10, 2025):

- Ticker Symbol: AFRM

- Stock Exchange: NASDAQ

- Current Stock Price: $46.40

- Market Capitalization: $14.85 Billion

- Revenue (ttm): $2.80 Billion

- Net Income (ttm): -$198.93 Million

- Shares Outstanding: 320.10 Million

- EPS (ttm): -0.63

- PE Ratio: N/A (due to negative earnings)

- Forward PE Ratio: 220.95

- Dividend: N/A

- Day’s Trading Range: $44.16 – $49.78

- 52-Week Range: $22.25 – $82.53

- Beta: 3.64

- Analyst Rating: Buy

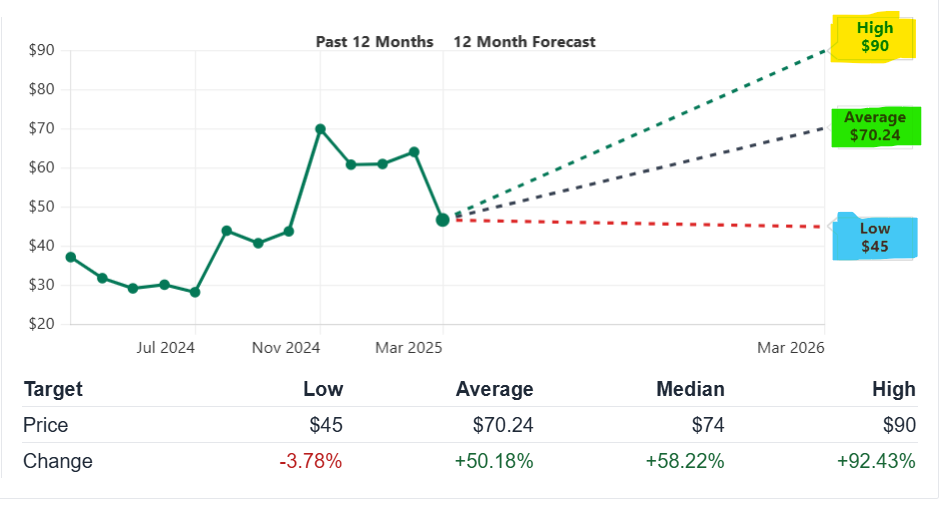

- 12-Month Price Target: $70.24 (approximately +51.38% upside)

- Earnings Date: February 6, 2025

Statistical data about the company produces a dual effect that combines solid revenue expansion alongside persisting losses. Analysts maintain positive outlook towards AFRM despite current difficulties because they have assigned it a 12-month target that exceeds original share valuation.

Forecast Methodology: How We Predict the Future

Predicting stock prices involves careful analysis of various factors. Our forecast for Affirm Holdings is built on the following pillars:

Historical Data Analysis

We study past price behavior and market cycles. Affirm has experienced significant volatility in its 52-week range, from as low as $22.25 to as high as $82.53. This historical context helps us set realistic boundaries for future price movements.

Technical Analysis

We use technical indicators such as moving averages, Relative Strength Index (RSI), and beta. For instance, Affirm’s beta of 3.64 suggests higher-than-average volatility. The RSI, which is around 28.14, points to oversold conditions, possibly signaling a rebound. These tools help us determine support and resistance levels and forecast potential corrections.

Expert Forecasts and Analyst Sentiment

Nineteen analysts currently rate AFRM as “Buy,” with an average 12-month price target of $70.24. This expert consensus guides our long-term outlook, even as we adjust for monthly fluctuations.

Fundamental Analysis

Although Affirm is currently posting losses (with an EPS of -0.63), its revenue is growing at an impressive rate (up 46.29% in the latest period). The company’s innovative approach in the buy-now-pay-later space, partnerships with major merchants, and significant market share contribute to its long-term growth potential.

Market Sentiment and Economic Trends

The overall market environment, including trends in consumer finance, digital payments, and economic conditions, plays a vital role. As consumer behavior shifts toward digital transactions and flexible payment solutions, Affirm’s platform could see further adoption.

Yearly Forecast Predictions (2025–2030)

Below is our detailed forecast for Affirm Holdings, broken down by year and by month. Each year’s section provides a textual explanation followed by a table that lists the minimum, average, and maximum predicted prices in U.S. dollars.

Note: These predictions are based on our current research and are subject to change as market conditions evolve.

Forecast for 2025

In 2025, we expect Affirm Holdings to follow a mixed trend. The stock is likely to see both upward moves and short-term corrections as the market adjusts post-earnings and responds to macroeconomic factors.

Monthly Predictions

- January 2025:

The new year might start cautiously. We estimate a range from $46.400 (current price) to $47.983, with an average price around $47.200. - February 2025:

With initial earnings reports boosting sentiment, prices could rise to a range of $48.250 to $49.800, with an average near $49.025. - March 2025:

As market confidence builds, our forecast suggests a range from $49.900 to $51.450, averaging approximately $50.675. - April 2025:

Following the earnings release on February 6, the stock may climb to between $51.600 and $53.200, with an average around $52.400. - May 2025:

Continued positive momentum could push prices to a range of $53.250 to $55.000, with an average near $54.125. - June 2025:

Mid-year trends might show a rally, with prices ranging from $55.100 to $56.850, averaging approximately $56.000. - July 2025:

As summer trading brings renewed activity, prices could move between $56.900 and $58.650, with an average of about $57.775. - August 2025:

With growing market optimism, the range may be $58.700 to $60.500, averaging near $59.600. - September 2025:

Expect a moderate correction amid high trading volumes, with prices between $60.550 and $62.300, and an average of roughly $61.425. - October 2025:

Seasonal factors may drive the price higher, with a forecast range of $62.350 to $64.150, averaging around $63.250. - November 2025:

The market might see further improvement, with prices from $64.200 to $66.000, averaging about $65.100. - December 2025:

As the year closes, we anticipate a strong finish with prices ranging from $66.050 to $68.000, with an average near $67.025.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 46.400 | 47.200 | 47.983 |

| February | 48.250 | 49.025 | 49.800 |

| March | 49.900 | 50.675 | 51.450 |

| April | 51.600 | 52.400 | 53.200 |

| May | 53.250 | 54.125 | 55.000 |

| June | 55.100 | 56.000 | 56.850 |

| July | 56.900 | 57.775 | 58.650 |

| August | 58.700 | 59.600 | 60.500 |

| September | 60.550 | 61.425 | 62.300 |

| October | 62.350 | 63.250 | 64.150 |

| November | 64.200 | 65.100 | 66.000 |

| December | 66.050 | 67.025 | 68.000 |

Forecast for 2026

For 2026, Affirm Holdings is expected to benefit from improved fundamentals and growing market acceptance. Although the trend is generally upward, periodic corrections will introduce some volatility.

Monthly Predictions

- January 2026:

The year may open with prices ranging from $67.050 to $68.500, with an average near $67.775. - February 2026:

As consumer spending stabilizes, expect a range from $68.750 to $70.200, averaging approximately $69.475. - March 2026:

Technical indicators suggest a bullish phase, with prices between $70.250 and $71.800, with an average of about $71.025. - April 2026:

Encouraging quarterly results might push the price range to $71.850 – $73.400, averaging around $72.625. - May 2026:

The stock may continue its upward trend with prices from $73.450 to $75.000, with an average near $74.225. - June 2026:

Mid-year optimism could drive prices between $75.100 and $76.650, with an average of about $75.875. - July 2026:

Summer trading may see a range of $76.700 – $78.250, averaging approximately $77.475. - August 2026:

With robust market conditions, prices might move between $78.300 and $79.850, with an average around $79.075. - September 2026:

Expect some consolidation as investors book profits, with prices ranging from $79.900 to $81.400, averaging near $80.650. - October 2026:

Seasonal factors may boost prices to a range of $81.450 – $83.000, with an average of approximately $82.225. - November 2026:

The stock may see further gains, trading between $83.100 and $84.650, averaging about $83.875. - December 2026:

The year might close strongly with a forecast range from $84.700 to $86.250, with an average near $85.475.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 67.050 | 67.775 | 68.500 |

| February | 68.750 | 69.475 | 70.200 |

| March | 70.250 | 71.025 | 71.800 |

| April | 71.850 | 72.625 | 73.400 |

| May | 73.450 | 74.225 | 75.000 |

| June | 75.100 | 75.875 | 76.650 |

| July | 76.700 | 77.475 | 78.250 |

| August | 78.300 | 79.075 | 79.850 |

| September | 79.900 | 80.650 | 81.400 |

| October | 81.450 | 82.225 | 83.000 |

| November | 83.100 | 83.875 | 84.650 |

| December | 84.700 | 85.475 | 86.250 |

More From Bernini Capital :

- Nike Stock Price Forecast, Price Prediction and Technical Analysis (2025-2030)

- TSMC Stock Price Forecast and Technical Analysis (2025-2030)

- Paypal (PYPL) Stock Price Prediction, Forecast, Detailed Analysis (2025-2030)

- SoFi Technologies (SOFI) Stock Forecast Analysis and Price Target (2025-2030)

- CrowdStrike Holdings, Inc. (CRWD) Stock Price Forecast and Prediction (2025-2030)

- SoundHound AI, Inc. (SOUN) Stock Price Prediction, Forecast and Analysis (2025-2030)

Forecast for 2027

For 2027, our analysis shows that Affirm Holdings is expected to continue its recovery as the market grows more confident. However, the stock may experience more pronounced fluctuations as investor sentiment shifts and profit-taking occurs.

Monthly Predictions

- January 2027:

The new year may start with prices in the range of $86.300 to $87.850, averaging around $87.075. - February 2027:

With steady growth, prices could range from $88.000 to $89.550, with an average of approximately $88.775. - March 2027:

A modest rally might see the stock trading between $90.200 and $91.750, averaging near $91.000. - April 2027:

Encouraging quarterly results may boost prices from $91.500 to $93.050, with an average around $92.275. - May 2027:

As consumer adoption increases, the forecast suggests a range of $93.200 – $94.750, with an average near $94.000. - June 2027:

Seasonal corrections could result in a range from $94.800 to $96.350, with an average around $95.575. - July 2027:

Summer trading might push prices between $96.500 and $98.050, with an average near $97.275. - August 2027:

The stock could further rise with prices in the range of $98.200 to $99.750, averaging about $99.000. - September 2027:

Investor profit-taking may cause a slight pullback, with a range of $99.800 – $101.350, averaging approximately $100.575. - October 2027:

A rebound could drive prices to a range from $101.500 to $103.050, with an average near $102.275. - November 2027:

The stock may trade between $103.200 and $104.750, with an average of about $104.000. - December 2027:

The year could close with strong performance, with prices ranging from $104.800 to $106.350, averaging approximately $105.575.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 86.300 | 87.075 | 87.850 |

| February | 88.000 | 88.775 | 89.550 |

| March | 90.200 | 91.000 | 91.750 |

| April | 91.500 | 92.275 | 93.050 |

| May | 93.200 | 94.000 | 94.750 |

| June | 94.800 | 95.575 | 96.350 |

| July | 96.500 | 97.275 | 98.050 |

| August | 98.200 | 99.000 | 99.750 |

| September | 99.800 | 100.575 | 101.350 |

| October | 101.500 | 102.275 | 103.050 |

| November | 103.200 | 104.000 | 104.750 |

| December | 104.800 | 105.575 | 106.350 |

Forecast for 2028

In 2028, with the semiconductor market maturing and Affirm’s platform becoming more integrated in consumer finance, the stock is expected to climb steadily. Yet, natural corrections will ensure the monthly figures do not follow a robotic pattern.

Monthly Predictions

- January 2028:

The year might begin with prices between $107.100 and $108.900, averaging about $108.000. - February 2028:

With growing confidence, prices could range from $109.000 to $110.800, with an average near $109.900. - March 2028:

A bullish trend may push the stock to trade between $111.000 and $112.800, averaging approximately $111.900. - April 2028:

Seasonal demand could drive prices from $113.000 to $114.800, with an average around $113.900. - May 2028:

The company’s growth story may carry the stock between $115.000 and $116.800, averaging about $115.900. - June 2028:

Mid-year trading might see a range of $117.000 to $118.800, with an average near $117.900. - July 2028:

Summer trends may support prices from $119.000 to $120.800, averaging approximately $119.900. - August 2028:

As market conditions remain favorable, expect a range from $121.000 to $122.800, with an average around $121.900. - September 2028:

A slight correction may occur, setting prices between $122.000 and $123.800, averaging near $122.900. - October 2028:

A rebound could drive prices from $124.000 to $125.800, with an average around $124.900. - November 2028:

The market may stabilize with prices ranging from $126.000 to $127.800, averaging about $126.900. - December 2028:

The year might close strongly, with a forecast range of $128.000 to $129.800, and an average near $128.900.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 107.100 | 108.000 | 108.900 |

| February | 109.000 | 109.900 | 110.800 |

| March | 111.000 | 111.900 | 112.800 |

| April | 113.000 | 113.900 | 114.800 |

| May | 115.000 | 115.900 | 116.800 |

| June | 117.000 | 117.900 | 118.800 |

| July | 119.000 | 119.900 | 120.800 |

| August | 121.000 | 121.900 | 122.800 |

| September | 122.000 | 122.900 | 123.800 |

| October | 124.000 | 124.900 | 125.800 |

| November | 126.000 | 126.900 | 127.800 |

| December | 128.000 | 128.900 | 129.800 |

Forecast for 2029

Assuming Affirm Holdings continues to recover and capture market share in the evolving digital payments space, our forecast for 2029 shows further upward movement, albeit with natural corrections along the way.

Monthly Predictions

- January 2029:

Prices might start the year in the range of $131.000 to $132.900, with an average near $131.950. - February 2029:

As market confidence builds, expect a range from $133.000 to $134.900, averaging approximately $133.950. - March 2029:

Technical momentum may drive prices between $135.000 and $136.900, with an average around $135.950. - April 2029:

Positive sentiment could push prices from $137.000 to $138.900, averaging near $137.950. - May 2029:

Continued growth might see prices in the range of $139.000 to $140.900, with an average around $139.950. - June 2029:

Mid-year trading could result in a range from $141.000 to $142.900, averaging approximately $141.950. - July 2029:

Summer trends may support a range of $143.000 to $144.900, with an average near $143.950. - August 2029:

A slight pullback may occur, with prices between $145.000 and $146.900, averaging about $145.950. - September 2029:

Consolidation may set prices in the range of $147.000 to $148.900, with an average near $147.950. - October 2029:

A modest rebound could drive prices from $149.000 to $150.900, averaging around $149.950. - November 2029:

The stock might trade between $151.000 and $152.900, with an average of $151.950. - December 2029:

The year may close strongly with a range of $153.000 to $154.900, averaging near $153.950.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 131.000 | 131.950 | 132.900 |

| February | 133.000 | 133.950 | 134.900 |

| March | 135.000 | 135.950 | 136.900 |

| April | 137.000 | 137.950 | 138.900 |

| May | 139.000 | 139.950 | 140.900 |

| June | 141.000 | 141.950 | 142.900 |

| July | 143.000 | 143.950 | 144.900 |

| August | 145.000 | 145.950 | 146.900 |

| September | 147.000 | 147.950 | 148.900 |

| October | 149.000 | 149.950 | 150.900 |

| November | 151.000 | 151.950 | 152.900 |

| December | 153.000 | 153.950 | 154.900 |

Forecast for 2030

Looking ahead to 2030, if Affirm continues its recovery and adapts to the changing consumer finance landscape, our forecast projects further upward movement with periodic market corrections.

Monthly Predictions

- January 2030:

The new decade may start with prices ranging from $156.000 to $157.900, with an average around $156.950. - February 2030:

A slight increase might push prices from $158.000 to $159.900, averaging approximately $158.950. - March 2030:

Continued momentum could see prices between $160.000 and $161.900, with an average near $160.950. - April 2030:

Optimistic market conditions may drive prices from $162.000 to $163.900, with an average around $162.950. - May 2030:

A bullish phase might result in a range of $164.000 to $165.900, averaging about $164.950. - June 2030:

Mid-year trading might yield prices between $166.000 and $167.900, with an average near $166.950. - July 2030:

Summer stabilization may drive prices from $168.000 to $169.900, averaging around $168.950. - August 2030:

A mild pullback could set a range of $170.000 to $171.900, with an average near $170.950. - September 2030:

As the market consolidates, prices might range from $172.000 to $173.900, averaging approximately $172.950. - October 2030:

A rebound may see prices between $174.000 and $175.900, with an average around $174.950. - November 2030:

The stock might trade in a range from $176.000 to $177.900, averaging about $176.950. - December 2030:

The final month could see a strong close with prices ranging from $178.000 to $179.900, with an average near $178.950.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

|---|---|---|---|

| January | 156.000 | 156.950 | 157.900 |

| February | 158.000 | 158.950 | 159.900 |

| March | 160.000 | 160.950 | 161.900 |

| April | 162.000 | 162.950 | 163.900 |

| May | 164.000 | 164.950 | 165.900 |

| June | 166.000 | 166.950 | 167.900 |

| July | 168.000 | 168.950 | 169.900 |

| August | 170.000 | 170.950 | 171.900 |

| September | 172.000 | 172.950 | 173.900 |

| October | 174.000 | 174.950 | 175.900 |

| November | 176.000 | 176.950 | 177.900 |

| December | 178.000 | 178.950 | 179.900 |

Essential Company Information

For quick reference, here are the key details about Affirm Holdings:

| Category | Detail |

|---|---|

| Company Name | Affirm Holdings, Inc. |

| Ticker Symbol | AFRM |

| Stock Exchange | NASDAQ |

| Current Stock Price | $46.40 |

| Market Capitalization | $14.85 Billion |

| Revenue (ttm) | $2.80 Billion |

| Net Income (ttm) | -$198.93 Million |

| Shares Outstanding | 320.10 Million |

| EPS (ttm) | -0.63 |

| Forward PE Ratio | 220.95 |

| Dividend | N/A |

| Day’s Trading Range | $44.16 – $49.78 |

| 52-Week Range | $22.25 – $82.53 |

| Beta | 3.64 |

| Analyst Rating | Buy |

| 12-Month Price Target | $70.24 (approx. +51.38% upside) |

| Earnings Date | February 6, 2025 |

| Website | Affirm Holdings |

Detailed Technical Analysis

A solid technical analysis is key to understanding our forecast for Affirm Holdings. Here’s a detailed breakdown of the technical factors influencing the stock:

Moving Averages

- 50-Day Moving Average:

The current 50-day moving average is around $63.11. Trading above this average typically indicates short-term bullish momentum. - 200-Day Moving Average:

At approximately $46.75, the 200-day moving average serves as a long-term support level. Sustained trading above this level suggests overall strength.

Relative Strength Index (RSI)

- The RSI for Affirm is about 28.14, indicating that the stock is near oversold territory. This may signal a potential buying opportunity if the trend reverses.

Beta and Volatility

- With a beta of 3.64, Affirm Holdings exhibits high volatility relative to the broader market. This means the stock can experience significant swings, both upward and downward, in the short term.

Trading Volume and Liquidity

- Affirm’s average trading volume of approximately 7,631,500 shares per day suggests strong liquidity. This reduces the risk of drastic price changes during large trades.

Chart Patterns and Historical Volatility

- Historical data shows that Affirm’s stock has experienced dramatic price fluctuations, with its 52-week range spanning from $22.25 to $82.53. These historical patterns help inform our monthly forecast ranges.

Bear and Bull Case Scenarios

Evaluating potential risks and rewards is crucial. Below are five key points for both the bear and bull cases regarding Affirm Holdings.

Bear Case (Downside Risks)

- Global Economic Downturn:

A recession or slowdown in consumer spending could reduce demand for flexible payment solutions. - Intensifying Competition:

The fintech space is highly competitive, and new entrants or improvements by rivals could erode Affirm’s market share. - Regulatory Challenges:

Increased scrutiny or changes in financial regulations may raise compliance costs and slow growth. - High Volatility Risk:

With a beta of 3.64, any negative market sentiment or poor earnings can trigger sharp price declines. - Valuation Correction:

If revenue growth slows, investors might reassess Affirm’s high forward PE ratio, leading to a significant price correction.

Bull Case (Upside Potential)

- Robust Revenue Growth:

Affirm has shown impressive revenue growth (up 46.29% in recent periods). Continued adoption of its payment platform could drive further gains. - Technological Innovation:

Affirm’s commitment to improving its digital payment solutions can keep it ahead of competitors. - Positive Analyst Sentiment:

With a “Buy” rating and a 12-month price target of $70.24, expert views support a strong upward trend. - Expanding Market Opportunities:

As consumers increasingly move towards digital and installment payment methods, Affirm is well-positioned to capture a larger share of this market. - Strong Partnerships:

Strategic alliances with major merchants and financial institutions can boost Affirm’s market penetration and revenue growth.

Frequently Asked Questions (FAQ)

Q1. What is Affirm Holdings’ current market status?

As of March 10, 2025, Affirm is trading at $46.40 with a market cap of $14.85 billion. Analysts rate it as a “Buy” with a 12-month price target of $70.24.

Q2. How does technical analysis affect the forecast?

Technical indicators such as the 50-day and 200-day moving averages, RSI, and beta help us gauge the stock’s momentum, volatility, and potential support/resistance levels, which are critical for our monthly predictions.

Q3. What risks could negatively impact Affirm’s stock?

Risks include a global economic downturn, rising competition, regulatory challenges, high volatility, and potential valuation corrections if growth slows.

Q4. What factors could drive Affirm’s stock higher?

Upside drivers include robust revenue growth, innovative technology, positive analyst sentiment, expanding market opportunities, and strategic partnerships with key merchants.

Q5. Where can I find updated information on Affirm Holdings?

For the latest data, check trusted sources like Yahoo Finance and Reuters, or visit the Affirm website.

Conclusion

The prediction for Affirm Holdings during 2025 through 2030 results from evaluating historical information alongside technical trends and expert professional insights. The trend will be mixed yet upward moving while experiencing regular market adjustments.

Market investors should assess both opportunity and hazard aspects before choosing while receiving data from trustworthy market sources. The guide delivers comprehensive instructions regarding Affirm’s future potential.

1 thought on “Affirm Holdings (AFRM) Stock Price Forecast & Technical Analysis (2025-2030)”