1. Company Overview and Market Context

Paylocity Holding Corporation (PCTY) is a company that offers cloud-based payroll and human capital management software. Its stock trades on the Nasdaq under the ticker symbol PCTY. Investors pay attention to PCTY because the firm is known for steady growth in revenue and earnings. The company is well positioned within the technology and human resources software sector. Current information on PCTY can be found on the Nasdaq website here.

On a recent trading day, PCTY reported a market price of 180.29 USD, which placed it among the notable mid-cap technology stocks. Investors follow key indicators such as moving averages, beta, and P/E ratios for technical insight. Today’s market open and real-time pricing data are essential details that help investors gauge the stock’s momentum.

Table of Contents

2. Historical Performance Analysis

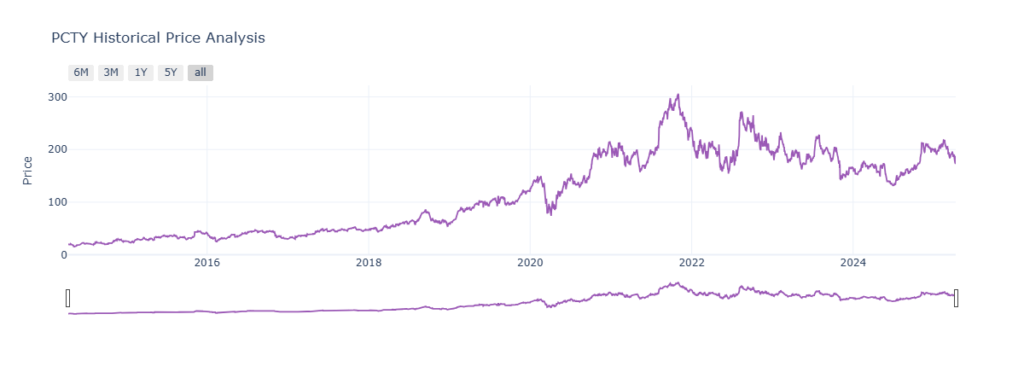

PCTY’s historical price performance provides context for current and future price predictions. Historical records show price data for key months, including price movements from 2024 through early 2026. Analysts review past monthly lows, averages, and highs to determine trends. For instance, data shows specific monthly records for April 2024, November 2024, and January 2025. These historical numbers form the basis of technical analysis and forecast predictions.

An examination of the historical price analysis table reveals that over recent months, the stock has moved between specific ranges. For example, in October 2024 the stock traded at an average level before experiencing upward pressure. Later, in early 2025, slight downturns were observed before a recovery began. Historical trading ranges help to signal where the stock might settle as market sentiment and economic factors evolve.

For further historical data and charts, investors can review analysis on Yahoo Finance here.

3. Technical Indicator Insights

Technical indicators provide a snapshot of the stock’s trends. The analysis uses moving averages and trend lines to determine current trading momentum. The 50-day and 200-day moving averages for PCTY, presently sitting around 197.72 USD and 179.54 USD respectively, suggest that the stock has experienced both support and resistance areas in recent trades.

Short-term technical insights indicate some pressure below resistance levels while longer-term indicators point to steady recovery over time. Key support levels seem to form around the lower forecast figure (approximately 122.47 USD) while resistance is near or above the higher forecast number (roughly 214.41 USD). Investors monitor these levels to determine entry or exit points in a tactical manner.

Charts and technical data often appear on sites like MarketWatch. Additional technical details and interactive charts are available here.

4. Forecast Price Analysis

The forecast for PCTY over the next 12 months is derived from comprehensive historical data and current market conditions. Analysts have provided a range of predictions over several upcoming months:

- Forecast Low: This is the minimum predicted price level. For example, for April 2025, forecast low levels reached around 180.29 USD. In subsequent months, forecast lows varied with the lowest levels noted near 121.95 USD in one of the earlier periods.

- Forecast Average: The average range for April 2025 is predicted around 181.89 USD, with subsequent months showing averages rising as market momentum builds.

- Forecast High: The highest price levels may exceed 214 USD on several occasions, indicating periods when the stock might react positively to strong fundamentals.

Tables provided in the data indicate that forecast intervals such as “Jul 2024” and “Oct 2025” have been computed based on both technical indicators and comprehensive fundamental reviews. Investors use these forecasts for planning short-term trading moves or longer-term holdings.

For an extended forecast analysis, a detailed report can be seen on Investing.com here.

5. Fundamental Financial Analysis

The solid performance of PCTY is also supported by strong financial fundamentals. Detailed financial highlights include:

- Revenue and Earnings: The revenue for the trailing twelve months (ttm) reached approximately 1.5B USD, with an impressive quarter-over-quarter revenue growth of 28.20%. This growth reflects increasing market penetration in a competitive sector.

- Profit Margins: The profit margin stands at around 14.76%, an indicator that the company maintains a healthy balance between cost control and revenue generation.

- Earnings Per Share (EPS): With a current EPS of 3.89 and positive year-over-year trends, the company demonstrates an ability to generate shareholder value. Historical EPS data from earlier quarters indicates a steady upward trend, although analysts note minor variations.

- Valuation Measures: The forward P/E ratio is 24.15, and the PEG ratio sits at approximately 1.33. Both numbers provide an insight into the stock’s relative valuation and expected earnings growth.

- Debt and Liquidity: PCTY’s low total debt compared to its market capitalization and robust operating cash flow (around 393.11M USD) bolster its financial health. The current ratio of 1.14 and a decent free cash flow indicate stability and a sufficient cushion against market downturns.

For further reading on company fundamentals, check Reuters’ financial overview here.

6. Analyst Recommendations and Outlook

Analysts have a range of recommendations on PCTY. According to recent consensus reviews:

- The current market sentiment places PCTY in the “Buy” or “Strong Buy” category.

- Price targets include an estimated average target of 180.29 USD. Some analysts have set high projections, reaching as high as 236.48 USD.

- The earnings estimates for upcoming quarters and fiscal years project continued growth. Current Qtr. estimates stand at 2.12 USD, with further improvements expected in subsequent quarters.

In addition, analysts have revised their projections based on observed market trends. The forecasted numbers, such as forecast averages and highs for the upcoming month, reflect careful consideration of overall market conditions and the company’s robust fundamentals.

More detailed analyst reviews and recommendation summaries can be read on Seeking Alpha here.

7. Month-by-Month Forecast and Expected Movements

The month-by-month forecast for PCTY shows how various factors might influence price levels. The data provides details on forecast low, average, and high price predictions from April 2025 until early 2026.

For instance:

- April 2025:

- Forecast Low: 180.29 USD

- Forecast Average: 181.89 USD

- Forecast High: 180.29 USD (notable when compared to past month averages)

- May 2025 to December 2025:

- The stock shows fluctuations. One month’s forecast shows lows near 147.57 USD while the subsequent month could see highs nearing 214.41 USD.

- Early 2026 Trends:

- As the forecast covers into January and February 2026, a range between 145.15 USD to 198.32 USD is observed.

These fluctuations suggest that price volatility exists and investors should pay attention to how market conditions shift. The presence of technical indicators such as moving averages and oscillators help contextualize these numbers. Market participants consider these numbers in light of economic data releases, earnings reports, and industry-specific developments.

For a practical chart view of these trends, access interactive analytics on TradingView here.

Also Read – GE Vernova (GEV) Stock Price Forecast & Prediction With Technical Analysis (2025-2030)

8. Market Dynamics and Drivers

Stock movement in PCTY is influenced by several factors. Key elements include:

- Earnings Announcements: Investors react to quarterly earnings releases. The upcoming earnings reported between April 30, 2025, and May 5, 2025, hold particular interest.

- Technical Levels: The support near the forecast low and resistance near forecast high set clear boundaries for trading. This technical behavior is viewed by traders as decisive in identifying entry or exit points.

- Economic Indicators: Broader economic conditions, including inflation data, employment figures, and market sentiment towards technology stocks, all play significant roles.

- Sector Performance: As a tech-oriented company in human resources software, PCTY competes with other technology firms. Changes in the competitive landscape or shifts in customer demand can alter forecasted prices.

These market drivers are reflected in both technical charts and fundamental performance indicators. Reliable analysis from established financial data websites assists in understanding these dynamics. Comprehensive market news is available from sites like Bloomberg here.

9. Company-Specific Developments

PCTY has made several operational strides in recent periods. The company continues to innovate with its software suite for human capital management. Recent product enhancements have been well received in the market. On the operational front, investments in technology infrastructure have contributed to improved performance, as seen in rising EPS figures and steady revenue increases.

The company’s investment in research and development supports a forecast of improved market penetration. Investor reports note that performance improvements are aligned with strategic initiatives. These initiatives include enhancing the cloud infrastructure, expanding services, and strengthening customer relationships. Each of these areas influences financial and technical indicators.

Company updates and official news releases are accessible on the Paylocity website here.

10. Risks and Considerations

Every forecast comes with a set of risks that investors must weigh. Despite strong fundamentals, PCTY faces potential challenges such as:

- Market Volatility: Fluctuations in the broader market may affect the stock’s performance. Sudden changes in market sentiment could influence technical levels.

- Earnings Variability: Minor surprises in quarterly earnings may lead to adjustments in forecast predictions. Investors are encouraged to monitor earnings releases closely.

- Competitive Pressures: The human resources software sector is competitive. Shifts in competitive dynamics may influence market share and pricing power.

- Economic Uncertainty: Macroeconomic factors, including interest rate changes and global economic trends, could impact investor sentiment towards technology stocks.

Traders and investors must consider these factors while using the forecast data as a part of broader investment strategies. More detailed risk assessments can be found on analyst platforms such as Zacks Investment Research.

11. Final Analysis and Investment Strategy

For investors looking at PCTY, the stock offers a blend of technical and fundamental strengths. Historical price trends show that the stock recovers from dips. Technical indicators reveal support at lower levels, while resistance tends to build around the forecast highs.

Financial metrics such as revenue growth, EPS improvements, and strong operating cash flow build confidence in long-term prospects. The forecast data, including monthly ranges from April 2025 through early 2026, provides potential entry points and exit strategies. Trading decisions should incorporate both the provided forecast range and independent market research.

The stock forecast analysis suggests that PCTY could be a beneficial holding for those who favor a mix of technical analysis and fundamental research. Investors might consider waiting for technical breakouts above key resistance levels before increasing exposure. Conversely, buying near established support levels may offer a more conservative entry.

One should always combine the forecast data with current economic news and update models based on the latest data. Tools such as interactive charts on TradingView and detailed analyses on Bloomberg help in making informed decisions.